Slice up your credit card bill with Plan&Pay

A thrifty new instalment plan option on your St.George credit card.

What is Plan&Pay?

Plan&Pay is a repayment plan for your credit card. It splits your credit card repayments into smaller bite-sized instalments.

There are two types of Plan&Pay:

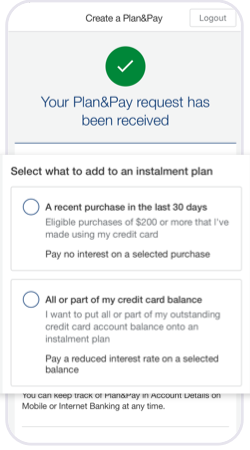

- Purchase Plan&Pay for single purchases of $200 or more made within the last 30 days.

- Balance Plan&Pay for any credit card balance (or part of a credit card balance) of $200 or more.

Enjoy the smarts of Plan&Pay

Which Plan&Pay works for you?

See which option could help you manage your credit card expenses.

Purchase Plan&Pay

Great for those single credit card purchases of $200 or more made within the last 30 days. When you need easier repayments for purchases like new white goods, a holiday or a laptop for example.

Balance Plan&Pay

For any credit card balance (or part of a credit card balance) of $200 or more. For times when you’ve had extra monthly expenses or need to manage a balance transfer.

What could a 3, 6 or 12-month Plan&Pay purchase cost you?2

Made some big buys this month? Here are 3, 6 or 12-month Purchase Plan&Pay examples as a guide. The actual costs of any Plan&Pay will be confirmed during setup in the St.George App or in Online Banking.

3 months

- Purchase value: $500

- Upfront fee: 1% ($5)

- Monthly instalment $168.33

- Interest: 0% if you pay within 3 months

6 months

- Purchase value: $1,000

- Upfront fee: 2% ($20)

- Monthly instalment $170

- Interest: 0% if you pay within 6 months

12 months

- Purchase value: $2,000

- Upfront fee: 4% ($80)

- Monthly instalment $173.33

- Interest: 0% if you pay within 12 months

More to love

How to set up

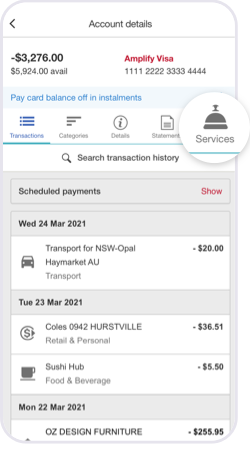

1. Select Plan&Pay

Click the ‘Services’ bell on your credit card Account details page, then select ‘Plan&Pay instalment plans’.

2. Make a plan

Choose to set up a Plan&Pay plan for any recent eligible purchase, or to pay off your balance.

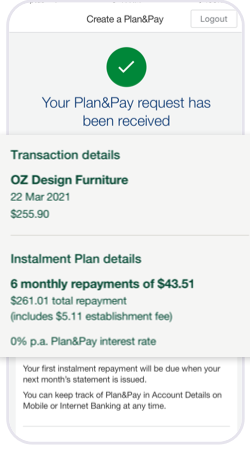

3. Confirm the details

Fill out the remaining information, choose your repayment schedule, then hit confirm to finish.

Some common Plan&Pay questions answered

Simply logon to Internet Banking or the St.George Bank Mobile Banking App to set up and manage a Plan&Pay Instalment Plan. To create a Balance Plan&Pay, choose either a credit card balance, or a Balance Transfer balance with 3 or more calendar months remaining on the balance transfer period. You also have the option of choosing a Cash Advance Balance.

To create a Purchase Plan&Pay, simply view your recent transactions. Any purchase of $200 or more made within the last 30 days will have the option to‘Pay off in instalments’ at 0% p.a. interest. An upfront fee will also apply.1

Things you should know:

1. 0% interest rate applies to Purchase Plan&Pay only. The establishment fee payable varies depending on the instalment plan term plan selected and will be added to your account balance. If you’re close to your credit limit, check this fee won’t take you overlimit.

2. Subject to the St.George Bank Credit Card Terms and Conditions (PDF 1008KB).

3. Balance Plan&Pay plans have different interest rates. Logon to your Internet or Mobile Banking to compare Balance Plan&Pay rates against your standard rates.

This information does not take your personal objectives, circumstances or needs into account. Consider its appropriateness to these factors before acting on it. Read the Credit Card Terms and Conditions before deciding. Unless otherwise specified, the products and services described on this website are available only in Australia from © St.George - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.